COST SAVING METHODS IN FUNERAL SERVICE OPTIONS

In keeping with being a “teaching funeral home” and the public’s sense of an increasingly unpredictable financial climate, Rutherford Cremation & Funeral Services has put together a list of some very practical ways to keep funeral costs lower for those who are looking to do so, without compromising the respectful honouring of the one that is loved and departed.

In an effort to put you in control of your choices and carry out the deceased’s wishes, it is important to have the information so that proper decisions may be made. Throughout the years now we have served families where money is no object and families that have struggled with the cost of the most straightforward funeral service – and indeed, like everything else, funerals are not immune from inflation. Despite your financial situation, the options for services might be the same but the cost does not necessarily have to be.

This would be an appropriate time once again to remind you, dear reader, that honouring someone has nothing to do with how much money is being spent. You cannot equate a tangible sum to how much you love and miss someone.

Here then, are some options for you to consider:

THE SELECTION OF THE SERVICE: I am an advocate for carrying out the deceased’s last wish. If there was nothing discussed concerning disposition, (burial, cremation, aquamation, graveside service, traditional service, etc.) the options are open. These are the typical services offered by some funeral homes from most costly to least costly. Traditional Service / Memorial Service / Celebration of Life Service / Graveside Service / Direct Aquamation / Direct Cremation / Donation of Body to Science.

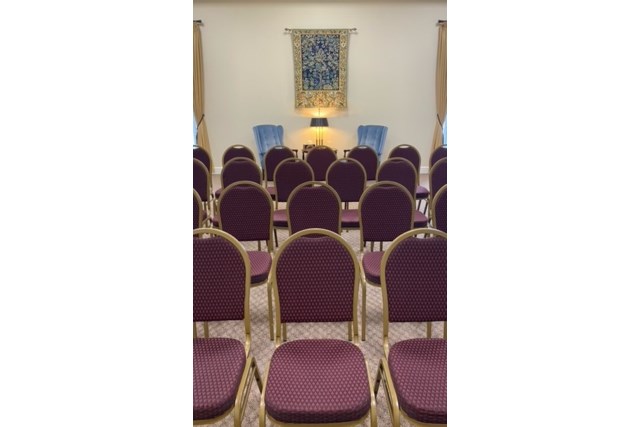

FUNERAL HOME INVOLVEMENT OR NOT: If a casket is involved at any kind of service, with the decedent present, a funeral home will be involved – but not necessarily if a cremation or an aquamation has been carried out beforehand. Enquire with the funeral home about how they would be involved if they are participating in what is called a memorial service or celebration of life service, and the cost difference between holding the service at the funeral home or elsewhere. You may want to create your own tribute.

URNS: Urns for cremated or aquamated remains are options, not necessities. You may also use a family heirloom or receptacle from home to house the remains. Likewise, if an urn is not desired, you can still hold a memorial service with a photograph of your loved one present without having the urn on display.

CASKETS: There are always more modestly priced caskets that have an elegance equal to more costly options. If a cremation or aquamation is desired after a service has been carried out, rather than paying for a “rental casket” (talk to the funeral home about what that is), there are some natural wood containers that may be used for a service. In fact, more than once, we have used a modest wooden casket on which those attending the service have written their names and their farewells with colourful sharpie markers along with their children who have drawn images in crayon. This idea provides for a very unique and personal down-to-earth service in which people may participate directly. Photographs of the casket have been taken as keepsakes. This is of course, not to everyone’s taste. But, who cares about everyone else if the deceased would have loved it… right?!

VAULTS: Vaults for caskets and urns in a cemetery burial are most often options and not necessities. There are specific areas in cemeteries where vaults are required as the ground may be compromised due to angle of the earth or dampness of the ground or some such thing, but generally the decision is yours.

OBITUARIES: Obituaries are free on funeral home websites but not in newspapers. Some folks nowadays forego the newspaper option and that often depends upon a few things – the cost of the notice, whether there will be a service or not, if everyone could be told verbally that your loved one has died, if most every relative or friend is predeceased, etc.

FLOWERS: Flowers definitely add beauty to a gathering. But if money is a concern, instead of buying a casket spray for a traditional service, consider the simple elegance of a single long-stemmed red rose laying atop the casket. Anytime this option has been chosen, the love for the deceased is just as heartfelt as it would be with a spray atop the casket. A designed bouquet of flowers for a funeral will usually cost more than purchasing loose flowers for the service.

TIME OF SERVICE: It is always less costly to have a visitation and a service on the same day rather than holding a visitation on one day and the service on another. Likewise, it may be more costly to hold two visitation periods rather than one. Check with the funeral provider.

TIME/DATE OF BURIAL: If an urn or casket is to be buried in a cemetery, have the funeral home check the cemetery by-laws concerning additional costs for burying on a weekend and the cost of “overtime” for cemetery staff, if the burial extends beyond the official closing hours of the cemetery.

RECEPTIONS: It’s not a requirement to hold a reception. The cost of receptions includes the cost for the space and the cost of the food. Usually, it is a prescribed amount per, however many people you think will attend. This can often be one of the costliest parts of any service depending upon that number. Funerals and subsequently, receptions, can be private events for folks who are invited to attend and need not be a public forum. Receptions also need not be carried out at a funeral home. If those attending are deemed to be a small number, or the gathering afterward is only for immediate family and friends, it could be a gathering in a local restaurant, the family home, the Legion or another space. Also, the time of reception may play a part. If the reception takes place around lunchtime, those attending may expect more of a meal than if the reception is held well before lunch or in the afternoon where a light snack may be all that is needed.

PRE-PAY YOUR FUNERAL ARRANGEMENT: Lock in costs by doing a pre-paid arrangement with the funeral home. It’s flexible in payment, the payment gains interest and the funeral is paid for when the time comes, with money left over for the family once the money has been used for the funeral specified. I’ve never met anyone who is not grateful for this thoughtful gesture so that the remaining family is not burdened with questions or finances. Pre-arrangements are transferrable to any funeral home, anywhere. No money is lost and they may be cancelled at any time.

UNTIL SOON. LIVE WELL.